Cryptocurrency Tax Philippines

MANILA Philippines Tax authorities are now studying how to put in place a registry for play-to-earn games in a move to capture the burgeoning cryptocurrency deals in the Philippines. Your income from crypto transactions will be taxed as short-term gains if you held the asset for a year or less before disposing of it.

Cryptocurrency Taxation In The Philippines An In Depth Guide

736 Bangko Sentral ng Pilipinas Guidelines for Virtual Currency VC Exchanges Circular No.

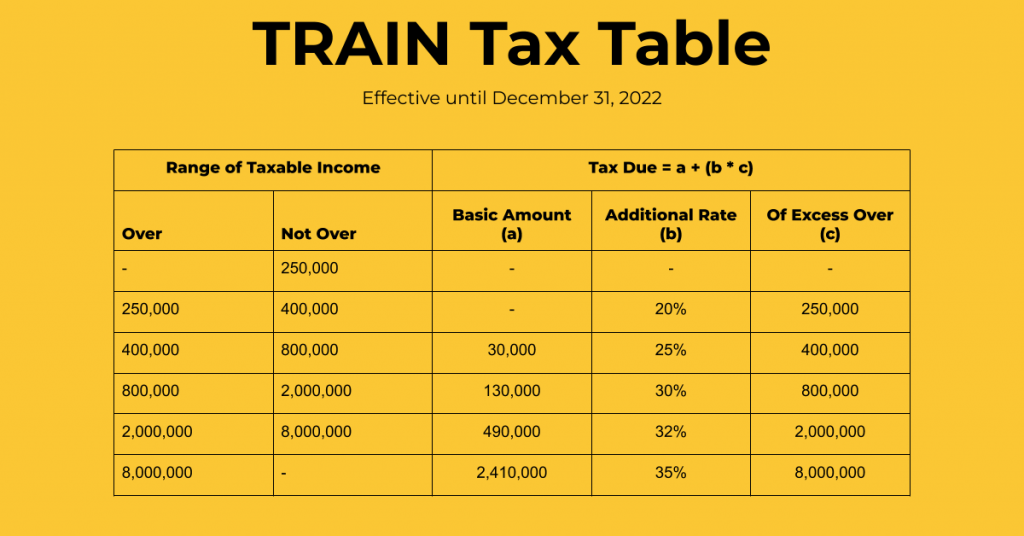

Cryptocurrency tax philippines. The federal tax rate for short-term gains is the same as the tax rate for income. Cryptocurrency Tax Philippines Play-to-Earn Axie Infinity Tax 101 by PDAX and Taxumo Tagalog 15 Oct 2021. Philippine Tax Classifications and Cryptocurrency Income Tax.

Yes In the Philippines capital gains tax will need to be paid on any profits you make. So once youve converted your crypto into actual money you should now begin to file your income tax returns. For gifts over this threshold donors may have to file a Gift Tax Return Form 709.

In the Philippines however the BIR has not yet issued specific guidelines on the classification of cryptocurrencies and the taxation of income earned from such. This was emphasized on the webinar Taxation of Digital Economy and Costs and Benefits of Customs Duties Moratorium on Electronic Transmissions which. The basics of crypto taxes.

Currently it can range from 10 to 37 depending on your total income. CryptoTraderTax offers good value compared to some equivalent products especially in the US49 for up to 100 trades tier. Tax Implications of Cryptocurrencies in the Philippines August 16 2018 May a transaction involving virtual currencies be subject to tax.

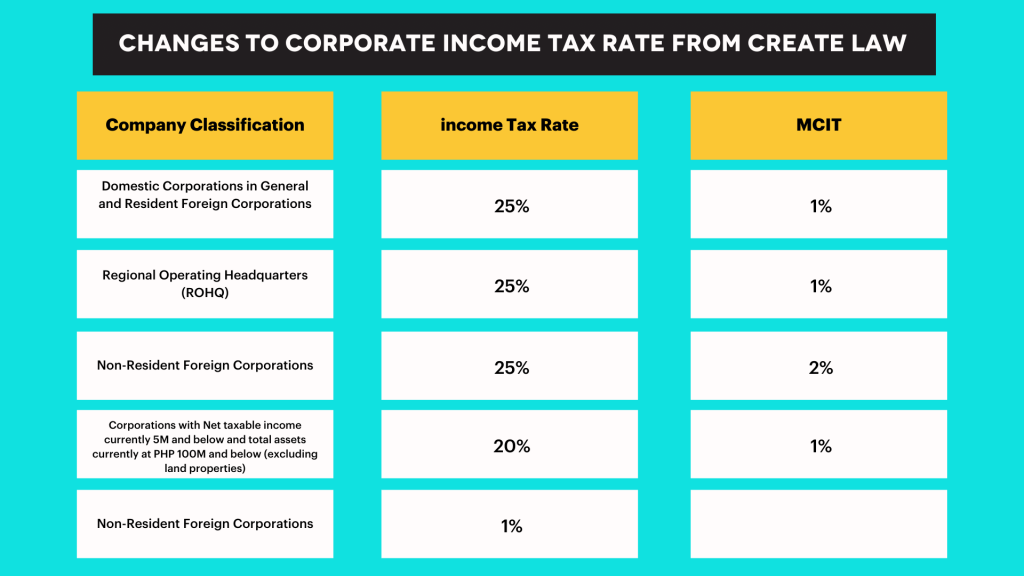

Any gain that is realized from cryptocurrency ie. Freeman Law can help with digital currencies tax planning and tax compliance. The Philippines has announced new regulations to govern crypto assets.

Well certainly the gains are subject to income tax she said. Cryptocurrency is an asset so its already taxable in the Philippines. All income from whatever source within the Philippines are taxable.

Contact us now or Schedule a consultation or call 214 984-3410 to discuss your cryptocurrency and blockchain technology concerns. The BIR has not presented any clear rules on the taxation of BTC transactions yet. Now what kind of tax applies.

Conversion to fiat becomes taxable. In the US cryptocurrencies like bitcoin are treated as property for tax purposes. According to the Inquirer these earnings must be taxed as incomes.

They charge a 49-59 depends on volume fee on each purchase. Whoever earns currency from it its income you should report it. Thus depending on the type of cryptocurrency transactions the Philippine Bureau of Internal Revenue BIR may impose an income percentage or other business tax under the NIRC regulation.

Just like other forms of property like stocks bonds and real-estate you incur capital gains and capital losses on your cryptocurrency investments when you sell trade or otherwise dispose of your crypto. Storms are gathering around hit crypto game Axie Infinity as regulators in its prime market the Philippines expressed their intention to tax its players and publisher. Gifting crypto is tax-free provided that your crypto gift does not exceed 15000 in value.

Coinmama allows customers in almost every country to buy bitcoin. THE Bureau of Internal Revenue BIR said those earning from cryptocurrency-based game Axie Infinity even the so-called scholars who earn from playing other peoples accounts must register. According to the Cagayan Economic Zone Authority Ceza a government.

CoinmamaBuy Now at Coinmamas Secure Site. A cryptocurrency beginners guide for the Philippines would not be completed with a tax question. BitPinas NFT Play To Earn Non Fungible Token Tagalog Cryptocurrency Tax Philippines 9 min read.

Marissa Cabreros Deputy Commissioner of the Bureau of Internal Revenue BIR Legal Group said that to effectively tax the digital economy an appropriate and legal framework must be in place. CryptoTraderTax saves even more time by giving you a thorough selection of completed documentation. Income from play-to-earn.

You wont pay tax when you buy crypto hold crypto or move your crypto between wallets. Customers in Europe can also purchase bitcoins with SEPA transfer for a lower fee. As discussed in the previous article while the Bangko Sentral ng Pilipinas BSP and Securities and Exchange Commission SEC have issued guidelines on cryptocurrencies the Bureau of Internal Revenue has remained silent on the matter.

Filing Taxes on Coinsph CoinTracker integrates directly with Coinsph to make tracking your balances transactions and crypto taxes easy. But since crypto is still unregulated here they cannot monitor it yet unless you declare ofc. You probably only need CryptoTraderTax at tax time so the fee comes as a one-off payment at tax time.

If cryptocurrency is received without any cost incurred by the taxpayer the value of the cryptocurrency is taxable. The Philippines Department of Finance DOF has issued a notice requiring people who earn profits through games like Axie Infinity to be taxed even if they are cryptocurrencies or non-fungible tokens NFTs.

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

Cryptocurrency Taxation In The Philippines An In Depth Guide

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

Philippines And Cryptocurrency Virtual Currency Laws Freeman Law

Cryptocurrency Taxation In The Philippines An In Depth Guide

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

Cryptocurrency Taxation In The Philippines An In Depth Guide

Cryptocurrency Taxation In The Philippines An In Depth Guide

Comments

Post a Comment